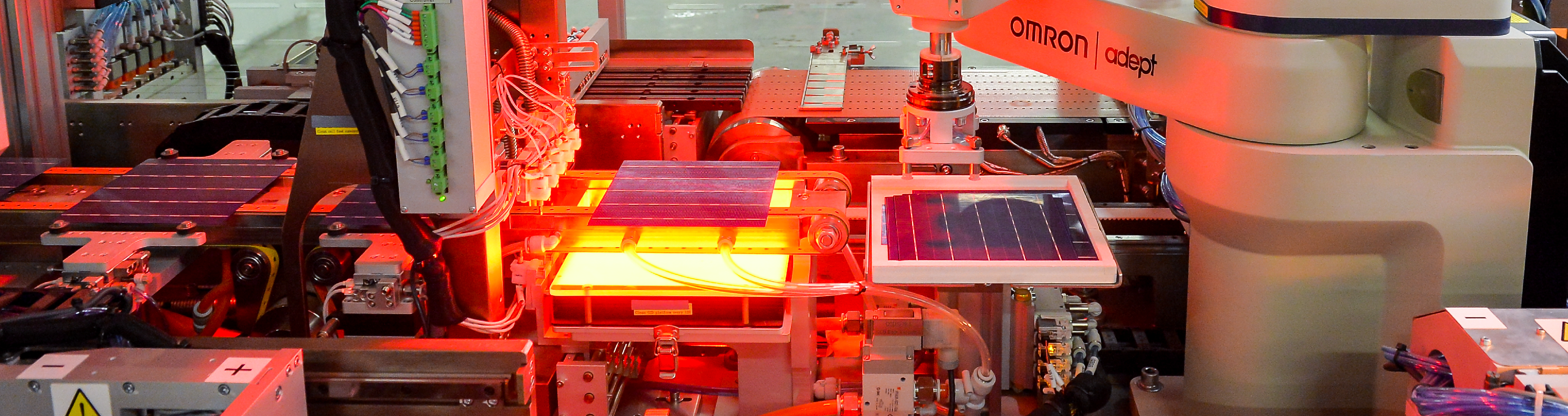

Advanced Manufacturing

What Does Georgia Offer

The cost-competitive and business-friendly environment along with tariff-free access to markets with a 2.3 billion population make Georgia the right place for manufacturing companies

Regional Hub and Market Access

Georgia has free trade agreements with the European Union, China, Turkey, Ukraine, EFTA and CIS countries, gaining tariff-free access to markets with a 2.3 billion population, which places Georgia at the center of key global value chains.

Young, skilled and competitively priced labor force

Georgia offers a young, skilled and competitive talent pool for the electronics industry. While total workforce amounts to 1.6 million, 55% of the workforce is 44 years old or younger, which means that a young skilled workforce is available on the market. The average monthly gross salary is 500 USD in the sector.

One of the lowest taxes globally

Georgia is the third-least tax-burdened country in the world (World Bank). Reinvested and retained profit is free from profit tax - companies pay profit tax only on distributed earnings. Personal income tax is one of the lowest in the world at 20% and the pension contribution is just 2% for the employer (2% paid by employee, 2% paid by government).

About 90% of goods are free from import tariffs in Georgia. In addition, Georgia has 4 Free Industrial Zones (FIZ). Businesses registered in FIZs benefit from additional tax exemptions: Companies producing goods for export in an FIZ are exempt from all taxes except personal income tax and pension contribution (20% & 2%).

One of the lowest utility costs

Up to 70% of power is generated via hydro and wind power plants, leading to greener and cheaper energy. 1 kWh of high voltage electricity costs about 8.5 USD cents, which is one of the lowest among the competitor countries.

Government Support

For companies engaged in manufacturing of electrical and electronic devices and compontents can benefit from support program of up to 15% cashback on capital investment and traning related costs